Arbitration/Deadlines: After Time Ran Out To Modify Arbitration Award, Plaintiff Could Still Seek To Amend Judgment To Add Additional Party

Plaintiff Finds Way Around JAMS Deadline

The next case illustrates the fundamental point that an arbitration award is not the same as a judgment, and that even after the time has expired under the governing arbitration rules to amend the award, it may still be possible to amend the judgment confirming the award. Butler v. Lyons & Wolivar, Inc., Case No. G04766 (4th Dist. Div. 3 March 3, 2014) (Fybel, Rylaarsdam, Aronson) (unpublished).

Plaintiff Butler arbitrated with his franchisor, the investigation firm Lyons & Wolivar Investigatins (Lyons), obtaining a net award of $512,244.67 against Lyons. So far, pretty good for Plaintiff. But when Plaintiff petitioned to confirm the arbitration award against both Lyons and its successor corporation, LWI, Inc. (LWI), the trial court refused to confirm the award against LWI, because the award only named Lyons.

So Plaintiff went back to the arbitrator to seek “clarification” that the award included LWI. Now the deadline in JAMS Rule 24 kicked in: the arbitrator had lost any power to modify the Final Award, because that award was more than 30 days old.

California Rule of Civil Procedure, section 187 came to the rescue: “Under section 187, the court has the authority to amend a judgment to add additional judgment debtors.” NEC Electronics Inc. v. Hurt, 208 Cal.App.3d 772, 778 (1989).

The Court of Appeal complimented Defendants for correctly setting forth “the law regarding judicial review of arbitration awards.” But then the Court retracted its compliment by pointing out that judicial review of an arbitration award is not the same as judicial review of a judgment – and here, the only issue was the correctness of the trial court’s order amending the judgment.

Judgment affirmed – also affirming the adage that “there’s more than one way to skin a cat.”

Arbitration/FINRA: Ninth Circuit Rules That Federal District Court Forum Selection Clause Trumps Financial Industry Regulatory Authority Arbitration

Court, Rather Than FINRA, Gets To Determine Arbitrability Of Dispute

Reno, Nevada, issued $211M in complex securities, known as auction rate securities (ARS). After the market for ARS collapsed in 2008, Reno sought FINRA arbitration with Goldman, Reno’s underwriter and broker-dealer. Reno’s theory was that if it had known that ARS were routinely propped up by companies such as Goldman, which withdrew market support during the 2008 financial market meltdown, it would never have made the investment in the first place.

In turn, Goldman sought a preliminary injunction in the federal district court to enjoin the FINRA arbitration. After the district court denied Goldman’s request for injunctive relief, Goldman appealed. Goldman, Sachs & Co. v. City of Reno, No. 13-15445 (9th Cir. March 31, 2014) (Bybee, Schroeder, Battaglia).

First, the Court of Appeals determined that the Court, rather than FINRA, had jurisdiction to determine arbitrability. “[W]hether the court or the arbitrator decides arbitrability is an issue for judicial determination unless the parties clearly and unmistakably provide otherwise.” Oracle Am., Inc. v. Myriad Group A.G.,

724 F.3d 1069, 1072 (9th Cir. 2013).

Second, the Court easily concluded that Reno was a “customer” of Goldman, giving it a right to invoke FINRA arbitration – unless Reno and Goldman contracted around arbitration.

Third, the Court held that through the forum selection clauses, the parties had indeed agreed to litigate claims in the USDC for the District of Nevada, thus contracting around FINRA arbitration.

However, because a preliminary injunction is within the discretion of the trial judge, the matter was remanded for further determination by the district judge.

Dissenting, Judge Battaglia would have affirmed the district court’s denial of Goldman’s motion to preliminarily enjoin FINRA arbitration.

BLAWG BONUS: “I shot a man in Reno just to watch him die.”

Arbitration/Pending Cases: SCOTUS Declines Hearing of Delaware Chancery Court Petition Seeking That Chancery Court Judges Be Allowed To Oversee Private Arbitrations

Closed System Of Business Arbitration Overseen By Judges Collides With First Amendment Right Of Access

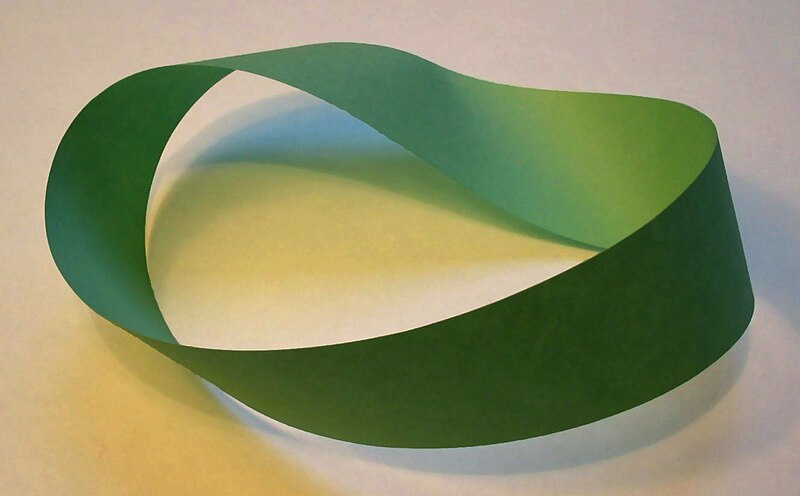

Möbius Strip. Wikimedia Commons. Author: David Benbennick. GNU Free Documentation License, v. 1.2.

On February 26, 2014, I posted the Delaware Chancery Court had petitioned SCOTUS to allow the Chancery Court to oversee private arbitrations. An arbitration forum provided by Chancery Court judges was thought to be attractive and a draw for large corporations, with heavy-weight commercial disputes, desiring the expertise of the Chancery Court and the privacy afforded by arbitration.

On March 24, 2014, Lyle Denniston reported in SCOTUSblog that on Monday, the Supreme Court declined review of the case, clearing “the way for the public and the press to sit in on arbitration of business disputes in Delaware, when a state judge acts as the arbitrator.” The case is Strine v. Delaware Coalition for Open Government, Inc.

Denniston explains the Delaware legislature had adopted the arbitration experiment because “it was concerned that other nations might be able to attract corporations to organize there by setting up user-friendly, closed systems of business arbitration.”

If the First Amendment provides a right of access to civil proceedings, including arbitrations administered by Chancery Court judges, that’s likely to be less of a draw for the multinationals.

Mediation/Condition Precedent: Fifth District Holds Homeowners Must Comply With Contractual Prelitigation Procedures With Homebuilder, Which Procedures Included Nonbinding Mediation

Failure Of Contractual Dispute Resolution Procedures In Contract To Track Protections In The Right To Repair Act Did Not Make The Provisions Unconscionable

The Right To Repair Act, Civ. Code sections 895 et seq., (Act) require a homeowner to provide a builder with notice of defects and an opportunity to investigate and repair them. However, the builder has the option of contracting for its own alternative nonadversarial prelitigation procedures when the home is sold. The Act applies to new residential units where the seller signed the purchase agreement on or after January 1, 2003.

Are homeowners who have purchased before January 1, 2003, or who have purchased after January 1, 2003, or who have purchased from those purchasers, bound by contractual prelitigation procedures, if those procedures do not track the procedures in the Act? That’s the problem presented in The McCaffrey Group, Inc. v. Superior Court, F066080 (5th Dist. March 24, 2014) (Gomes, Cornell, Franson).

And the answer? Yes, they are bound here, because the Court of Appeal found that the contractual procedures were not unconscionable, merely because they did not track the procedures in the Act. Furthermore, since unconscionability is determined as of the time of entering into the contract, the Act could not even be used as a yardstick for measuring unconscionability of those contracts entered into by purchasers who signed before the effective date of the Act.

When the homebuilder elected a contractual procedure, the homebuilder opted out of the nonadversarial prelitigation procedures prescribed by Chapter 4 of the Act, and the parties were bound by the contractual procedure. Here, the contractual procedure, while not providing all the same time deadlines as the Act, did provide times for accomplishing steps in prelitigation procedure. Also, the covenant of good faith and fair dealing placed an obligation on the homebuilder to act reasonably.

Here, the Court found a lack of substantive unconscionability, notwithstanding that the homeowners were contractually bound to pay half the mediation fees, while under the Act, the homeowner only splits fees if the homeowner agrees to do so. The Court signaled that there was a failure of proof, because the homeowners “made no attempt to show that the mediation fees they are likely to pay would be exorbitant or place an unreasonable burden on them . . . “

On one issue, however the Court punted: “Since we are ordering compliance with the contractual procedures, we do not decide whether the judicial reference clause is enforceable . . as some or all of the parties may resolve their complaints . . . “

Petition of The McCaffrey Group, Inc. granted.

Congratulations to attorney for petitioner Eddie Galloway (a former colleague of mine) and to his team at Jackson, DeMarco, Tidus & Peckenpaugh.

Arbitration/Rules: Amendments To Ethics Standards For Neutral Arbitrators In Contractual Arbitration

Ethics Standards 2, 3, 7, 8, 12, 16 and 17 are amended, effective July 1, 2014

Matthew Bender’s Rules of Court Special Update (December 2013) explains that Ethics Standards for Neutral Arbitrators in Contractual Arbitration, Standards 2, 3, 7, 8, 12, 16, and 17 are:

“amended to: (1) codify the holdings in decisions on the inapplicability of the standards to arbitrators in securities arbitrations and on the time for disclosures when an arbitrator is appointed by the court; (2) require new disclosures about financial interests a party or attorney in the arbitration has in an administering arbitration provider provider or the provider has in a party or attorney and about any disciplinary action taken against an arbitrator by a professional licensing agency; (3) clarify required disclosures about associations in the private practice of law and other professional relationships between an arbitrator’s spouse or domestic partner and a lawyer in the arbitration; (4) require arbitrators in consumer arbitrations to inform the parties in a pending arbitration of any offer of employment from a party or attorney for a party in that arbitration; and (5) prohibit arbitrators from soliciting appointment as an arbitrator in a specific case or specific cases.”

I was particularly pleased to see the addition of the following language to Standard 16, requiring disclosures in writing of the terms and conditions of the arbitrator’s compensation: “any requirements regarding advance deposit of fees; and any practice concerning situations in which a party fails to timely pay the arbitrator’s fees, including whether the arbitrator will or may stop the arbitration proceedings.”

I have seen an arbitration shut down after a party received an adverse ruling, and refused to advance or pay any more money to the arbitrator. The new disclosure required by Standard 16 likely won’t affect the how arbitrators react to non-payment, but at least all the parties and their attorneys will be informed and participate with eyes wide open, knowing that non-payment will probably result in a halt to arbitration, unless one party is willing to foot the entire bill.

Arbitration/Appealability/Stay/FAA: Ninth Circuit Holds There Is No Appeal From District Court Order Staying Judicial Proceedings And Compelling Arbitration

Court Addresses Unanswered Question As To Whether Stay Order Might Be Deemed “Final” Under “Collateral Order” Doctrine . . . No, Is The Answer

A Ninth Circuit panel has held that 9 U.S.C. section 16, the section of the Federal Arbitration Act dealing with appeals, bars appeals from a district court’s orders staying judicial proceedings and compelling arbitration of the named plaintiffs’ individual claims. Johnson v. Consumerinfo.com, Inc., Nos. 11-56520, 11-57182, and 11-57183 (9th Cir. March 20, 2014) (Hurwitz, Kleinfeld, Silverman).

To reach that conclusion, the Court shot down plaintiff’s arguments that the order being appealed from was a “collateral order”, and therefore really final, and that mandamus was justified as an alternative route to a higher court. While mandamus relief is not precluded by 9 U.S.C. section 16(b), it is an extraordinary remedy, and wasn’t justified here.